Authorized shares are those that a company is legally able to issue—the capital stock, while outstanding shares are those that have actually been issued and remain outstanding to shareholders. Preferred stock is another form of stock issued by companies or entrepreneurs sourcing capital from markets. Unlike common stock, preferred stock is not accompanied by voting rights and fixed dividends. The primary distinction between preferred and common stock is that common stock grants stockholders voting rights, while preferred stock does not. As a result, preferred shareholders get dividend payments before regular shareholders since they have a preference over the company’s income. For example, if you operate in a sector with high demand variability, your safety stock levels will need to be higher to accommodate potential spikes in sales.

- Get $30 off a tax consultation with a licensed CPA or EA, and we’ll be sure to provide you with a robust, bespoke answer to whatever tax problems you may have.

- Save more by mixing and matching the bookkeeping, tax, and consultation services you need.

- If the company fares poorly, both types of stock are likely to produce losses.

- The demand rate for the shoes also varies between 150 and 190 pairs per day.

What is your current financial priority?

So, now, we can easily calculate the probability that the order will be received in 7, 8, 9, 10, or 11 days. You can get these numbers if you dive the frequency for each delivery time with the total cases, in our case, the last ten orders. From these data, we can see that there is variability in delivery time, with a minimum value of 7 days and a maximum value of 11 days.

One big risk factor of common stocks

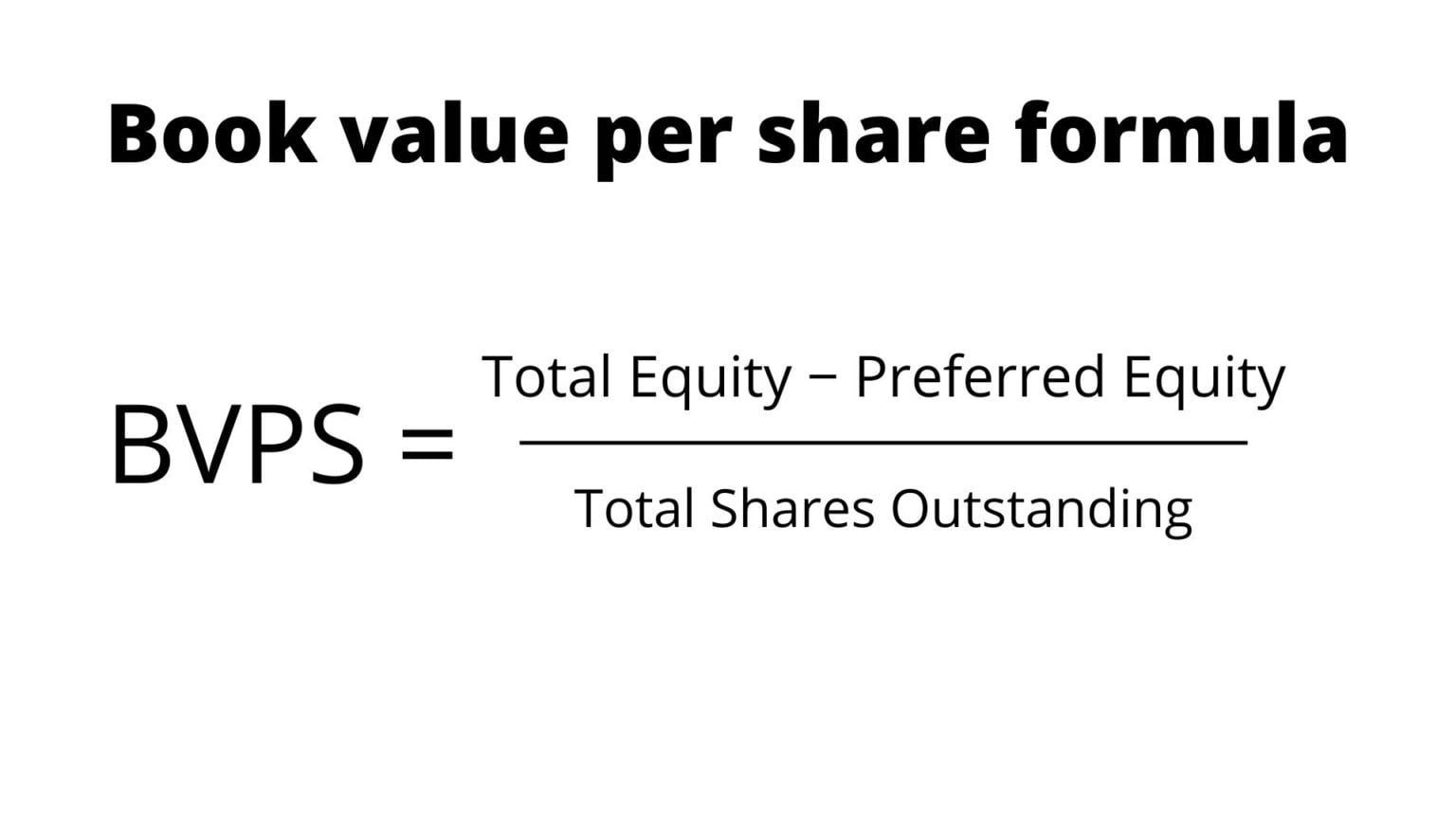

There is a clear distinction between the book value of equity recorded on the balance sheet and the market value of equity according to the publicly traded stock market. The “Treasury Stock” line item refers to shares previously issued by the company that were later repurchased in the open market or directly from shareholders. Next, the “Retained Earnings” are the accumulated net profits (i.e. the “bottom line”) that the company holds onto as opposed to paying dividends to shareholders. If shareholders’ equity is positive, that indicates the company has enough assets to cover its liabilities.

How to Calculate Cumulative Dividends Per Share

If a similar situation occurs with any preferred stocks you own, here’s how to calculate the cumulative dividends owed to you. Today, available technology, in large part, can help you manage inventory, conduct accurate forecasts, or even make predictions across the whole supply chain, etc. So, inventory management software can help you to optimize the level of your safety stock, ensuring you maintain the right balance between too much and too little inventory. This formula is the easiest method that allows you to calculate safety inventory level by considering your maximum daily usage and maximum lead time, subtracting the average daily demand and lead time. Here, Z represents the service factor, indicating your desired level of service. This factor represents the desired service level, indicating the probability of not running out of stock during the lead time.

Stockholders’ Equity and the Impact of Treasury Shares

On the other hand, if a company is doing poorly, common stock can decrease in value. Shares of common stock allow investors to share in a company’s success over time, which is why they can make great long-term investments. Treasury shares continue to count as issued shares, but they are not considered to be outstanding and are thus not included in dividends or the calculation of earnings per share (EPS).

Statistics and Analysis Calculators

If you’re very new to investing, you might still be getting familiar with what a stock is — and you might be distressed to find that there are, in fact, several different types of stocks. The British East India company xero config in actionstep practice pro + accounting used the same practice to expand its empire. Here we will guide you regarding common stock and provide you the tips on how to calculate common stock, but before that, we should know some basic information about stocks.

It embodies the total ownership available for distribution among investors. Capital stock is listed on the balance sheet in the shareholder’s equity section and represents the company’s equity capital. The financial report of a company gives you the scoop on how it’s doing, including the value of the stock per share.

Today, there are more than 2,000 companies whose common stocks are traded on the NYSE. If we rearrange the balance sheet equation, we’re left with the shareholders’ equity formula. Dividend recapitalization—if a company’s shareholders’ equity remains negative and continues to trend downward, it is a sign that the company could soon face insolvency. Risk premium can be thought of as the percentage that would need to be added to a risk-free return on investment to entice an investor into investing in the risky investment being offered. Once this percentage is added, the result is referred to as the required rate of return.