Companies prepare bank reconciliation statements as a comprehensive accounting comparison tool. A company can ensure that all payments have been processed accurately by comparing their internal financial records against their bank account balance. Bank reconciliation statements are also important for alerting a company in case of fraud or error.

Adjusting Discrepancies Between Books and Bank

It is up to you, the customer, to reconcile the cash book with the bank statement and report any errors to the bank. To quickly identify and address errors, reconciling bank statements should be done by companies or individuals at least monthly. They also can be done as frequently as statements are generated, such as daily or weekly. Non-sufficient funds (NSF) checks are recorded as an adjusted book-balance line item on the bank reconciliation statement.

Adjusting the General Ledger Balance

For the most part, how often you reconcile bank statements will depend on your volume of transactions. We’ll go over each step of the bank reconciliation process in more detail, but first—are your books up to date? If you’ve fallen behind on your bookkeeping, use our catch up bookkeeping guide to get back on track (or hire us to do your catch up bookkeeping for you). Preparing a bank reconciliation statement is done by taking into account all transactions that have occurred up until the date preceding the day the bank reconciliation statement is prepared. Journal entries, also known as the original book of entries, refer to the process of recording transactions as debits and credits, and once these are recorded, the general ledger is prepared. Nowadays, many companies use specialized accounting software in bank reconciliation to reduce the amount of work and adjustments required and to enable real-time updates.

Bank Reconciliation Statement FAQs

In huge companies with full-time accountants, there’s always someone checking to make sure every number checks out, and that the books match reality. In a small business, that responsibility usually falls to the owner (or a bookkeeper, if you hire one. If you don’t have a bookkeeper, check out Bench). These debits made by accrual accounting vs cash basis accounting the bank directly from your bank account will lead to a difference between balances. After adjusting all the above items, you’ll end up with the adjusted balance as per the cash book, which must match the balance as per the passbook. The reconciliation statement allows the accountant to catch these errors each month.

What Is a Bank Reconciliation Statement?

- The bank may send you a bank statement at the end of each month, each week, or, if your business has a large number of transactions, they may even send one at the end of each day.

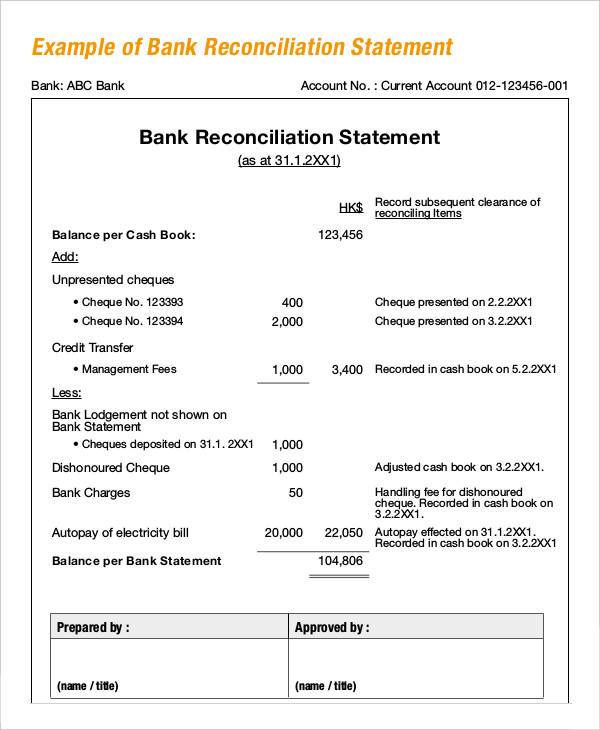

- Let’s take a look at a hypothetical company’s bank and financial statements to see how to conduct a bank reconciliation.

- Therefore, when preparing a bank reconciliation statement you must account for any fees deducted from your account.

- In the case of personal bank accounts, like checking accounts, this is the process of comparing your monthly bank statement against your personal records to make sure they match.

- Thank you for reading CFI’s guide to Bank Reconciliation Statement Template.

If your company receives bank statements more frequently, for example, every week, you may also choose to do a bank reconciliation for every statement you receive. The deposit could have been received after the cutoff date for the monthly statement release. Depending on how you choose to receive notifications from your bank, you may receive email or text alerts for successful deposits into your account. Once solved, be sure to adjust your records to reflect deposits as needed. The goal of bank account reconciliation is to ensure your records align with the bank’s records.

However, the depositor/customer/company credits its Cash account to decrease its checking account balance. However, the depositor/customer/company debits its Cash account to increase its checking account balance. The need and importance of a bank reconciliation statement are due to several factors.

In order to help you advance your career, CFI has compiled many resources to assist you along the path. Thank you for reading CFI’s guide to Bank Reconciliation Statement Template. For more resources, check out our business templates library to download numerous free Excel modeling, PowerPoint presentation, and Word document templates. Bank reconciliations may be tedious, but the financial hygiene will pay off. Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease.

As with deposits, take time to compare your personal records to the bank statement to ensure that every withdrawal, big or small, is accounted for on both records. If you’re missing transactions in your personal records, add them and deduct the amount from your balance. If you’re finding withdrawals that aren’t listed on the bank statement, do some investigation. If it’s a missing check withdrawal, it’s possible that it hasn’t been cashed yet or wasn’t cashed by the statement deadline.